A Chartered Accountant is an expert in taxation, auditing, accounting, and financial reporting in South Africa. Chartered Accountants work with individuals, companies, and other organizations to ensure accuracy and compliance with all relevant laws and regulations. They are highly qualified and experienced professionals who are responsible for providing financial information and advice to their clients.

Chartered Accountants help their clients keep accurate and up-to-date records of their financial activities, including accounting, taxation, budgeting, and auditing. They are also responsible for providing financial advice to their clients, making sure they understand the implications of any decisions they make. A Chartered Accountant can also assist with strategic and financial planning, including investment and capital management.

In South Africa, Chartered Accountants are regulated by the South African Institute of Chartered Accountants (SAICA), which sets the standards and qualifications needed to become a Chartered Accountant. To become a Chartered Accountant, an individual must have a relevant degree or diploma, pass the SAICA examinations, and complete a professional training course. Once an individual has met the requirements, they are then eligible to become a Chartered Accountant.

In conclusion, Chartered Accountants are highly

Contents

What Does A Chartered Accountant Do In South Africa

A Chartered Accountant in South Africa is a professional who uses their expertise in finance, tax, and accounting to help individuals and businesses with their financial needs. They assess and manage the financial health of businesses, help with tax and audit preparation and filing, and advise on the best course of action for managing money. They also provide insight on how to make investments and how to manage risk. With their knowledge of the South African financial system, they work to ensure companies stay compliant with the country’s regulations and laws. They also offer services such as financial planning, estate planning, and insurance planning. Chartered Accountants in South Africa are essential for any business that wishes to stay financially healthy and compliant with the law.

Overview of the Chartered Accountancy in South Africa

Chartered Accountancy in South Africa is an incredibly important profession in the country, providing invaluable services to individuals, businesses, and government departments. Chartered Accountants are experts in financial planning, taxation, and auditing, and are highly sought after for their expertise in these areas.

The history of Chartered Accountancy in South Africa dates back to the late 19th century, when the Institute of Chartered Accountants of South Africa (ICASA) was established in 1895. This institute was established to bring together the various accounting bodies in the country, create a unified set of accounting standards, and promote the professional development of Chartered Accountants. Since this time, the profession has grown significantly, and ICASA remains the governing body for the profession.

Chartered Accountants in South Africa are expected to abide by a strict code of ethics and maintain a high level of professional competence. As such, Chartered Accountants are highly respected and sought out by individuals, businesses, and government departments. Some of the services that Chartered Accountants offer include financial forecasting, financial analysis, auditing, and taxation advice. They also provide financial advice to their clients, helping them to make informed decisions about their finances.

Chartered Accountants are also responsible for ensuring the accuracy of financial documents and records. This involves a thorough review of all financial information, as well as ensuring that the documents and records adhere to the relevant accounting standards. They also provide advice on areas such as taxation and company law, helping their clients to make sure that they are compliant with the relevant laws.

Chartered Accountants have an important role to play in the South African economy. Through their services, they help businesses to stay profitable and compliant with the relevant laws and regulations. They also provide an invaluable service to the government, helping them to manage the country’s finances and ensure that the public’s money is being spent efficiently and effectively.

In conclusion, Chartered Accountancy in South Africa is an incredibly important profession, providing invaluable services to individuals, businesses, and government departments. Chartered Accountants are highly respected and sought after for their expertise in financial planning, taxation, and auditing. They play an important role in the South African economy, helping businesses to stay profitable and compliant with the relevant laws and regulations, and providing the government with invaluable financial advice.

Qualifications and Requirements to Become a Chartered Accountant in South Africa

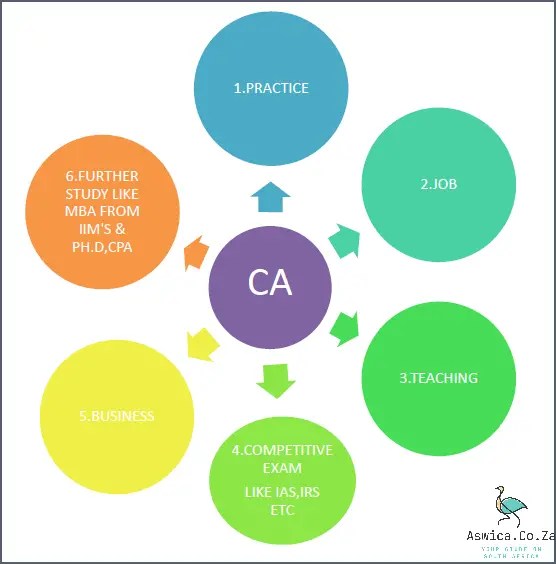

Becoming a Chartered Accountant in South Africa is no small feat. The qualifications and requirements are stringent and rigorous, and the process can be lengthy and costly. However, the rewards of being a Chartered Accountant are great, as the profession is highly respected, highly sought-after, and incredibly rewarding.

In order to become a Chartered Accountant in South Africa, you must meet a number of qualifications and requirements. Firstly, you must complete a Bachelor’s degree in Accounting, Finance, or a related field. This degree should be at least three years in length, and should be from a certified tertiary institution. After completing your degree, you must then complete a professional course that is offered by a recognized training provider. This course will typically take 18 to 24 months to complete, and will provide you with the practical skills and knowledge required to become a Chartered Accountant.

Once you have completed your professional course, you must then register with the South African Institute of Chartered Accountants (SAICA). SAICA is the professional body responsible for the regulation of the Chartered Accountant profession in South Africa. Once you are registered with SAICA, you must then complete a set of rigorous examinations in order to become a Chartered Accountant. These examinations can take up to two years to complete, and will cover topics such as auditing, financial reporting, taxation, and corporate law.

Once you have passed your examinations and registered with SAICA, you will be issued with a Certificate of Practice, which is the official document that proves that you are a Chartered Accountant. You will then be able to practice as a Chartered Accountant in South Africa.

In order to maintain your status as a Chartered Accountant, you must adhere to SAICA’s Code of Professional Conduct. This code outlines the ethical and professional standards that Chartered Accountants must adhere to in order to practice in South Africa.

Becoming a Chartered Accountant in South Africa is a rewarding and challenging process. It requires dedication and commitment, and a strong desire to excel in the profession. However, with the right qualifications and requirements, you can become a Chartered Accountant and enjoy the rewards and respect that comes with the title.

Responsibilities of a Chartered Accountant in South Africa

Chartered Accountants are among the most sought-after professionals in South Africa. They are highly respected and valued for their expertise in the field of accounting and finance, as well as their ability to provide valuable advice and guidance on important financial matters. As such, they have a range of responsibilities in the country, which include managing day-to-day financial operations, providing strategic guidance, and ensuring the accuracy of financial reporting.

One of the primary responsibilities of Chartered Accountants in South Africa is to keep accurate and up-to-date records of financial transactions and accounts. This includes maintaining accurate records of cash flow, managing payroll, preparing financial statements, and ensuring that all taxes are paid correctly and on time. Chartered Accountants must also ensure that all accounting data is secure and remains confidential.

In addition to keeping accurate records, Chartered Accountants in South Africa are also responsible for providing strategic financial advice. This includes advising on the best investments for an individual or business, as well as providing advice on budgeting and planning for the future. Chartered Accountants should also be able to provide guidance on risk management and financial regulations.

Finally, Chartered Accountants in South Africa are also responsible for ensuring the accuracy of financial reporting. This includes reviewing financial statements and reports to ensure accuracy, as well as providing assurance that the information is presented in accordance with applicable accounting standards. Chartered Accountants must also have the ability to spot errors, omissions, and discrepancies in financial reports, and should be able to provide solutions to rectify any issues.

Overall, Chartered Accountants in South Africa play an integral role in the financial success of individuals, businesses, and organizations. They are responsible for managing day-to-day financial operations, providing strategic advice, and ensuring the accuracy of financial reporting. Without the expertise and guidance of Chartered Accountants, financial operations in South Africa would be significantly more difficult.

Conclusion

A chartered accountant in South Africa is a professional who provides financial and tax services to businesses and individuals. They are responsible for preparing financial statements, calculating taxes, and providing advice on financial planning and investment decisions. Chartered accountants also work with auditors to ensure that financial statements are accurate and comply with regulations.