South Africa is one of the most vibrant economies in Africa and as such, imports and exports play a major role in the country’s economic success. As such, South Africa has imposed import duties on certain products and services entering their borders. Import duties, also known as customs duty, are taxes levied on goods and services entering or leaving a country. In South Africa, import duties are imposed on certain goods, depending on their origin and type, in order to protect local industries from foreign competition. The amount of duty imposed is determined by the South African Revenue Service (SARS) and is based upon the cost, insurance, and freight (CIF) value, including any additional charges. The CIF value is the total cost of the goods including the price, insurance, and all other charges. The total amount of duty imposed is then calculated based upon the CIF value, with different rates applying to different products and services.

In general, the rate of duty imposed is determined by the South African Customs Union (SACU). This is a trade agreement between South Africa and other members of the Southern African Customs Union (SACU) and the Common Monetary Area (CMA). The rate of duty can range from 0%

Contents

What Are The Import Duties In South Africa

Import duties in South Africa are the taxes that are levied on goods imported into the country. These duties are set by the South African Revenue Service and are based on the value of the goods being imported. The rate of duty varies from 0% to 45% depending on the type of goods being imported. Certain goods such as medicines, food, and raw materials are exempt from duties. When importing goods into South Africa, it is important to be aware of the applicable duties that will be charged. The duties are calculated based on the value of the goods and the duty rate applicable to them. Failure to pay the applicable duty can lead to the goods being confiscated, penalties, and possible prosecution.

Types of Imports Subject to Duty

When it comes to importing goods into South Africa, understanding the different types of import duties can be a daunting task. The South African Revenue Service (SARS) has established a system of tax classifications for imports, which can be broken down into several categories. In this article, we will discuss the different types of import duties subject to duty in South Africa.

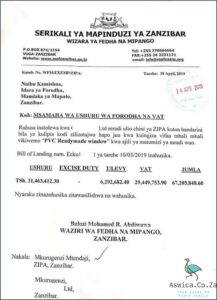

Customs duty is a tax imposed on all goods imported into South Africa. The amount of duty is based on the value of the goods, the country of origin, and the type of goods being imported. Generally, the higher the value of the goods, the higher the duty rate.

Excise duty is another type of import duty subject to duty in South Africa. This is a tax on certain types of imported goods, such as alcohol, tobacco, and fuel. It is calculated on the basis of the quantity and type of goods being imported.

Anti-dumping duties are imposed on imports that are considered to be being sold at prices lower than their normal market value. This type of duty is imposed to protect domestic producers from foreign competition.

Countervailing duties are imposed on imports that are found to have been subsidised by their country of origin. These duties are imposed to protect domestic producers from unfair competition.

Specific duties are imposed on specific types of imports, such as luxury cars, aircraft, and boats. The rate of duty is determined by the type of goods being imported.

Finally, there is Value Added Tax (VAT), which is imposed on all imports at the rate of 14%. This tax is calculated on the value of the imported goods, plus any applicable customs duty and excise duty.

In conclusion, there are a range of import duties subject to duty in South Africa. Depending on the type of goods being imported, the applicable duties will vary. It is important to understand these duties in order to ensure that all applicable taxes are paid in a timely manner.

How Much Duty Is Charged

When it comes to international trade and commerce, one of the most important factors to consider is the import duty charges that are applicable. South Africa is no exception, and business owners and consumers need to be aware of the applicable import duties when importing goods into the country.

Import duties in South Africa are set by the South African Revenue Service (SARS) and are based on various factors such as the type of goods being imported, the country of origin, and the value of the goods. Some goods may also be subject to additional taxes or fees, such as Value-Added Tax (VAT) or Anti-Dumping Duties.

Generally, the import duty rate for South Africa is calculated as a percentage of the value of the goods being imported. This percentage can range from zero to several hundred percent, depending on the type of goods and the country of origin. The applicable duty rate for each item can be found on the SARS website.

In addition to the import duty, SARS also levies a Customs Processing Fee on all goods that are imported into South Africa. This fee is based on the value of the goods and is charged in order to cover the cost of processing the goods through Customs. The fee can range from 0.3% to 3% of the value of the goods.

In some cases, goods may also be subject to additional taxes or fees such as Value-Added Tax (VAT) or Anti-Dumping Duties. VAT is a consumption tax that is charged on most goods and services in South Africa and is calculated as a percentage of the value of the goods. Anti-dumping duties are also imposed on certain imported goods that are deemed to be sold at a price lower than their fair market value.

It is important to note that import duties and fees may vary depending on the type of goods and the country of origin, so it is essential to be aware of the applicable charges when importing goods into South Africa. It is also important to ensure that the correct paperwork is completed and that all applicable taxes and duties are paid.

Overall, South Africa imposes import duties and fees on goods imported into the country, with the rates varying depending on the type of goods and the country of origin. It is important for businesses and consumers to be aware of the applicable charges, as failure to pay the correct duties and fees can result in fines and penalties.

Other Fees and Taxes

South Africa is a country that is both complex and diverse, and its import duties are no exception. Import duties in South Africa can be quite complicated, as they depend on the type of product being imported, its value, the point of origin, and its intended use. To understand the importance of import duties in South Africa, it’s helpful to look at the country’s economic and political structure.

South Africa is a complex mix of both developed and developing countries. As such, the nation has a highly developed economy, but it also has to contend with a large population of people who are living in poverty. This means that the government has to work to make sure that the country’s imports are not only affordable, but also fair. This is why the government imposes import duties, to make sure that imports do not become too expensive for the people of South Africa.

Import duties imposed on products imported into South Africa are generally set at a percentage of the total value of the product. This percentage varies between different products and is based on the type of product and its intended use. For example, the import duty on food items imported into South Africa is often lower than the import duty on luxury items. The import duty on luxury items, such as electronics, is also often higher than the import duty on food items.

In addition to the import duties, South Africa also imposes other taxes on imports. These taxes are generally imposed on products that are used for business purposes. These taxes are generally intended to help regulate the economy and ensure that businesses remain competitive.

Finally, it is important to remember that the import duties imposed in South Africa are not the only costs associated with importing goods into the country. Businesses must also be aware of local taxes, shipping costs, and other fees that may be imposed on imported products. Knowing these costs is essential for businesses to ensure that their imports are cost-effective and profitable.

In conclusion, understanding the importance of import duties and other taxes in South Africa is essential for businesses to ensure that their imports are cost-effective and profitable. Knowing the types of import duties in South Africa, as well as the taxes and other fees associated with importing goods, can help businesses make the most of their imports and remain competitive in the global market.

Conclusion

The import duties in South Africa are mainly based on the country of origin. For example, the import duties for goods from the European Union are much higher than for goods from other countries. The import duties also depend on the type of goods being imported and the amount being imported.