Repo rate is the interest paid on a loan of money which is being used as security for a future repayment. This rate is often used in the banking system to calculate the cost of borrowing.

Repo rate South Africa is the interest rate that banks charge each other for borrowing money. It is a very important rate because it affects the cost of borrowing for companies and governments. The Repo rate South Africa is fixed by the South African Reserve Bank (SARB) and it changes often.

The Repo rate South Africa is determined by a number of factors, including the interest rate offered by other banks, the state of the economy, and the amount of money that is available to borrow. The Repo rate South Africa is usually higher than the interest rate that banks charge borrowers in the UK and the US.

Contents

What Is Repo Rate South Africa

Repo Rate South Africa is the rate at which the South African Reserve Bank lends money to commercial banks in the country. It is the interest rate that banks are charged for borrowing money from the South African Reserve Bank. A higher repo rate implies that it is more expensive to borrow money from the South African Reserve Bank, and a lower repo rate implies that it is cheaper to borrow money from the South African Reserve Bank. This rate is used by the South African Reserve Bank to control the money supply in the country and to manage inflation. It is an essential tool used by the central bank to ensure economic stability and growth in the country.

Overview of South Africa’s Monetary Policy

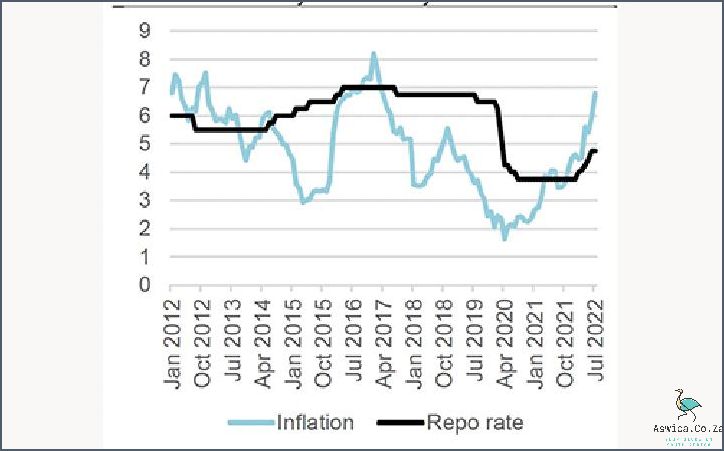

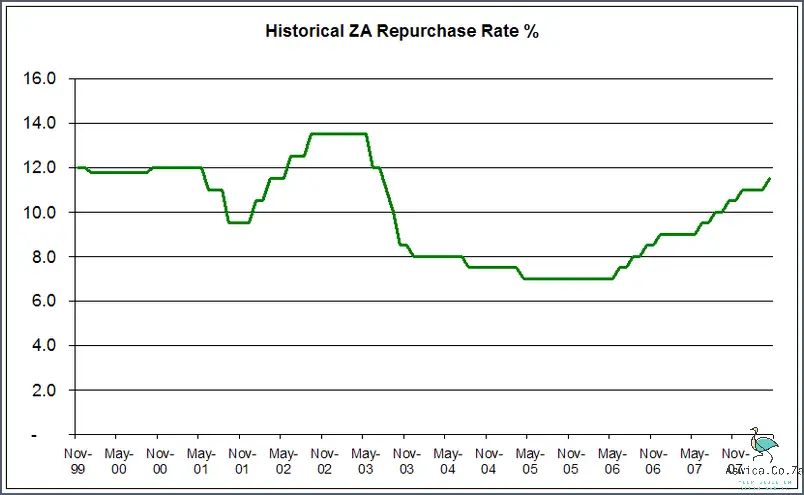

South Africa’s monetary policy has been a source of great interest in recent years, as the country’s economy continues to grapple with slow growth and rising inflation. The primary tool of the South African Reserve Bank (SARB) in managing the economy is the repo rate, which is the rate at which the SARB lends money to commercial banks. By adjusting the repo rate, the SARB can influence the cost of borrowing, and in turn, the availability of credit and the level of economic activity.

The repo rate is one of the most important levers of the SARB’s monetary policy. It is used to influence the availability of money and credit in the economy. By setting the repo rate, the SARB is able to influence the cost of borrowing for both businesses and consumers. When the repo rate is lowered, businesses and consumers have access to cheaper loans, which encourages spending and investment. On the other hand, when the repo rate is increased, borrowing becomes more expensive and businesses and consumers are less likely to borrow, resulting in slower economic growth.

The SARB’s main goal when adjusting the repo rate is to maintain a balance between economic growth and inflation. By keeping the repo rate low, the SARB can encourage economic growth, while keeping it too high can lead to deflationary pressures and a decline in economic activity. The SARB has to carefully consider the current economic conditions and future expectations in order to determine the most appropriate repo rate for the country.

At present, the repo rate in South Africa stands at 6.75%, which is lower than the historical average. This is a sign that the SARB is trying to boost economic growth, but inflation remains a concern. The SARB has been adjusting the repo rate in response to changing economic conditions and will continue to do so in the future.

Overall, the repo rate is a critical tool of the SARB’s monetary policy. It is used to influence the cost of borrowing and the availability of credit in the economy. The SARB will continue to carefully evaluate the economic situation and adjust the repo rate in order to maintain a balance between economic growth and inflation.

What is Repo Rate

The South African Reserve Bank (SARB) sets the repo rate, also known as the repurchase rate. This is the rate at which the SARB lends money to commercial banks in the form of short-term funds. The repo rate acts as the benchmark for the interest rate that banks charge their customers for borrowing money, and it affects the amount of money that is available in the economy.

The repo rate is a monetary policy tool and can be used by the SARB to control inflation. When the SARB increases the repo rate, it becomes more expensive for banks to borrow money from the SARB and therefore, increases the cost of borrowing for customers. This makes it harder for people to get loans and reduces the amount of money in circulation, which helps slow down inflation.

Conversely, when the SARB reduces the repo rate, it becomes cheaper for banks to borrow money from the SARB and the cost of borrowing for customers decreases. This encourages more people to borrow money, increasing the amount of money in circulation, and can help stimulate economic growth.

The SARB can also use the repo rate to influence the exchange rate of the South African rand. An increase in the repo rate strengthens the rand, while a decrease in the repo rate weakens the rand. This is because higher interest rates attract foreign investors, who then buy South African rand as an investment, increasing its value.

The repo rate is an important tool for the SARB to ensure that the South African economy remains stable. It is used to manage inflation, stimulate economic growth and maintain the value of the South African rand. It is important for people to understand the repo rate and its effects on the economy, as it can have a significant impact on their finances.

South African Reserve Bank’s Role in Repo Rate

The South African Reserve Bank (SARB) plays a pivotal role in maintaining economic stability in the nation through its implementation of the repo rate. Repo rate, otherwise known as the repurchase rate, is the rate at which the SARB lends money to commercial banks in South Africa. This rate is set and adjusted by the SARB in order to keep the economy stable and prevent the deflation or inflation of the South African rand.

When the SARB increases the repo rate, the commercial banks must pay a higher interest rate when borrowing money from the SARB. This, in turn, leads to an increase in the interest rate on consumer loans and mortgages. An increase in the repo rate is used to control inflation and slow down the rate of economic growth. On the other hand, when the SARB decreases the repo rate, commercial banks can borrow money from the SARB at a lower rate, leading to a decrease in consumer loan and mortgage rates. A decreased repo rate is used as a tool to stimulate the economy and encourage economic growth.

The SARB can also adjust the repo rate to ensure that the value of the South African rand remains within an acceptable range. By adjusting the repo rate, the SARB can encourage or discourage the flow of foreign currency into the country. When the repo rate is increased, it makes it more expensive for foreign investors to buy the rand, thus decreasing the demand for the currency and stabilizing its value. On the other hand, when the repo rate is decreased, it becomes cheaper for foreign investors to purchase the rand, which increases the demand for the currency and helps keep its value stable.

The South African Reserve Bank’s role in setting and adjusting the repo rate is an important one. By controlling the repo rate, the SARB can ensure that the economy remains stable, inflation is kept in check, and the value of the South African rand remains within an acceptable range. This helps to safeguard the nation’s financial stability and encourages economic growth.

Conclusion

Repo rate is an important factor to consider when borrowing money. It is a percentage of the loan amount that is paid back to the lender as interest. Repo rate in South Africa is currently at 6%. This is lower than the global average of 7%. However, it is still higher than some other African countries.