The current prime interest rate in South Africa is 6.5%. This is the interest rate that banks charge their customers for loans that are above a certain amount. The prime interest rate is the highest rate that banks can charge their customers.

Contents

What Is Current Prime Interest Rate In South Africa

South Africa’s current prime interest rate is 5.75%. This rate is determined by the South African Reserve Bank (SARB) and is used as a benchmark for other lending rates. It is important to note that the prime interest rate is subject to change at any time, as the SARB is responsible for setting and amending the rate when necessary. Generally, lenders will offer loans at a rate that is slightly higher than the prime rate. This is to cover the lender’s overhead costs and other expenses associated with providing the loan. Overall, the current prime interest rate in South Africa is 5.75% and is subject to change in the future.

History of Prime Interest Rate in South Africa

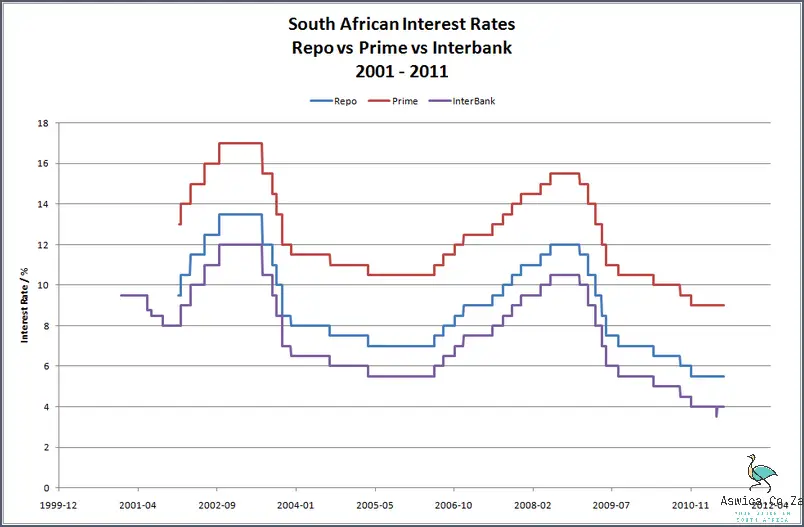

The prime interest rate in South Africa has an interesting history that has seen it rise to its current level of 7%. In the past, the prime interest rate in South Africa was much lower and had a more volatile history.

The prime interest rate in South Africa was first established in 1974 at 8%. This rate remained in place until 1979 when it was reduced to 6%. During this period, the prime rate was occasionally adjusted to counter the effects of inflation and stimulate the economy.

In the 1980s, the prime rate was increased to 12.5%, the highest rate ever recorded. This was in response to the financial crisis of the time, which had a major impact on the South African economy. However, the rate was gradually reduced over the following decade, with the prime rate falling to 8% in 1990.

In the 1990s, the prime rate began to rise again as the economy recovered from the financial crisis. By 2000, the prime rate had reached a high of 13.5%. The rate remained at this level until the 2008 global financial crisis.

Following the crisis, the prime rate was reduced to 9% and then to 8% in 2009. The rate remained at 8% until early 2017, when it was increased to 10.5% in response to the weak South African economy.

In 2020, the prime interest rate was increased again to its current level of 7%. This rise was due to the effects of the Coronavirus pandemic and the resulting economic recession.

Overall, the history of the prime rate in South Africa has been marked by a series of dramatic changes, with the current rate of 7% being one of the highest in the country’s history. This rate is likely to remain in place for the foreseeable future, as the South African economy continues to recover from the effects of the pandemic.

Current Prime Interest Rate in South Africa

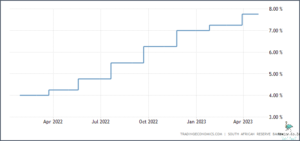

The current prime interest rate in South Africa is an important factor to consider when making financial decisions. It can have a significant impact on the cost of borrowing money and the return on savings. As of May 2021, the prime interest rate in South Africa stands at 7.00%.

The prime interest rate is the benchmark rate used by banks to set interest rates on loans and other forms of credit. It is determined by the South African Reserve Bank (SARB) and is used as a reference rate for banks when setting their own lending rates. The SARB sets the rate based on a variety of factors, such as the current economic situation, inflation and the exchange rate.

The current prime interest rate in South Africa is lower than it has been in the past. This is due to the country’s sluggish economic growth and weak inflation. As the economy begins to recover, the prime interest rate is expected to rise as well.

For borrowers, the current prime interest rate in South Africa means that loans are relatively inexpensive. This is good news for those looking to finance a purchase, such as a car or a home.

For savers, the current prime interest rate in South Africa means that they are receiving lower returns on their savings. This is because the prime rate is the benchmark used by banks to set interest rates on savings accounts. While the rate is still relatively low, it is expected to increase in the future.

The current prime interest rate in South Africa is an important factor to consider when making financial decisions. It is important to keep an eye on the prime rate and understand how it can affect both borrowers and savers. It is also important to remember that the prime rate is subject to change and can fluctuate over time.

Factors Affecting Prime Interest Rate in South Africa

The prime interest rate in South Africa is an important financial indicator that helps to determine the cost of borrowing and the returns on investments. As such, the rate has a significant impact on the economy of the country. In this article, we will explore the factors that influence the prime interest rate in South Africa and the current rate.

The prime interest rate in South Africa is set by the South African Reserve Bank (SARB). The SARB sets the rate in response to economic developments and market conditions. Generally, the rate is determined by the SARB’s Monetary Policy Committee, which takes into account a range of factors when setting the rate. These include inflation, economic growth, exchange rate movements, and the outlook for the global economy.

Inflation is one of the primary factors that affect the prime interest rate in South Africa. When inflation rises, the SARB may increase the rate to counter it. This is done to ensure that the cost of borrowing does not become too high, which could hamper economic growth. If the inflation rate is low, the SARB may reduce the rate to stimulate economic activity.

The exchange rate is another factor that influences the prime interest rate in South Africa. When the value of the South African rand is strong, the SARB may raise the rate to protect the value of the currency. This is done to ensure that South African assets remain attractive investments for foreign investors. However, if the rand weakens, the SARB may reduce the rate to make South African assets more attractive and encourage foreign investment.

The global economy also has a bearing on the prime interest rate in South Africa. If the global economy is strong, the SARB may raise the rate to take advantage of the strong economic conditions and to encourage investment. Conversely, if the global economy is weak, the SARB may reduce the rate in an effort to stimulate economic activity.

At the time of writing, the prime interest rate in South Africa is 7.00%. This rate was set by the SARB in response to economic and market conditions, and is likely to remain unchanged for the foreseeable future.

Conclusion

The current prime interest rate in South Africa is 8.50%. This is the rate that banks use to lend money to customers who have the best credit. It is important to note that the prime interest rate can change depending on the economic environment and other factors. It is important to monitor the prime interest rate in order to make educated decisions regarding borrowing and lending.