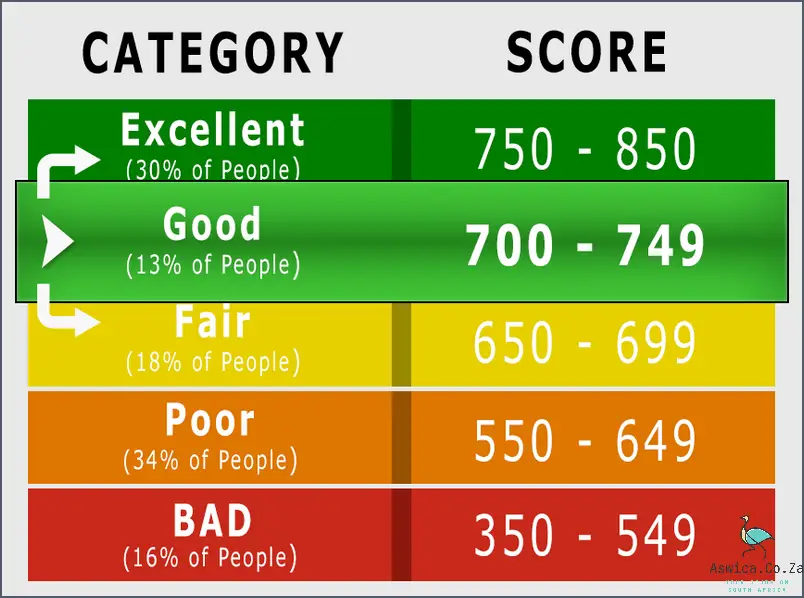

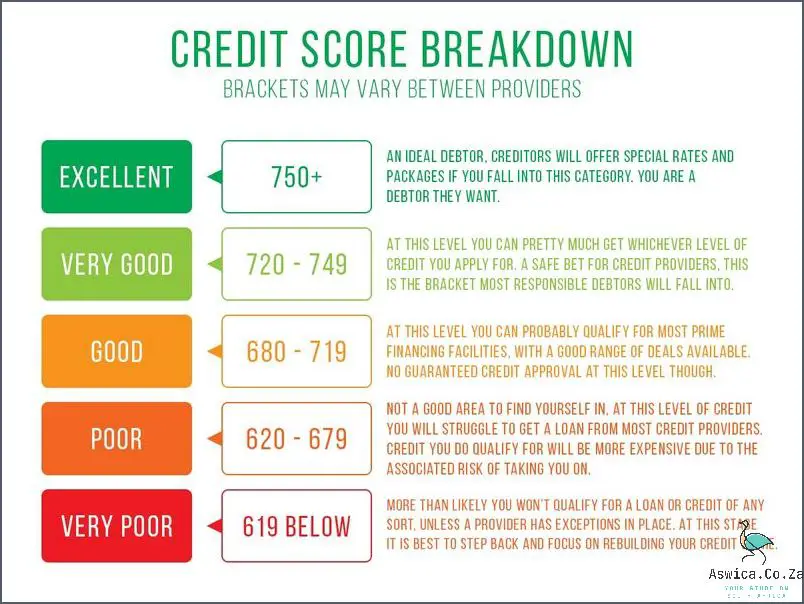

A good credit score in South Africa is a score that falls within the range of 550-900. This score is an indication of a person’s creditworthiness and is used to determine how likely they are to be approved for credit. A good credit score is generally considered to be in the upper range of the scoring scale, with anything over 700 being considered excellent. Having a good credit score can help you get access to more favourable loan terms, a larger loan amount, and lower interest rates. It is important to maintain a good credit score in South Africa by making timely payments and keeping your debt levels low. Doing so will ensure you can access credit when needed, and have access to the best loan offers when you need them.

Contents

What Is A Good Credit Score In South Africa

Having a good credit score in South Africa is very important in order to access financial products and services. Generally, a good credit score is one which is above 700. This score indicates that the person is likely to pay back the loan or other debts on time, and is therefore seen as a low risk. A good credit score is also important when applying for mortgages, car loans and other financial services. It is also important to note that a good credit score also reflects positively on your credit history, which can be beneficial when applying for further finance in the future. Therefore, it is important to understand the importance of having a good credit score in South Africa, and to make sure all payments are up to date in order to maintain a good credit score.

Overview of the credit scoring system in South Africa

The credit scoring system in South Africa is an important tool for assessing a person’s creditworthiness and financial stability. It helps lenders and other financial institutions quickly assess the creditworthiness of potential borrowers and determine whether or not they are eligible for a loan or other credit product. A good credit score is essential for anyone who wishes to access credit in South Africa.

Understanding the credit scoring system in South Africa is an important step towards achieving financial freedom. The National Credit Act (NCA) of South Africa sets out the rules and regulations governing the credit scoring system. The NCA has established a credit bureau system that collects and stores credit information for individuals and businesses. This information is then used to generate individual credit scores.

In South Africa, credit scores range from 0 to 1,000. A score of 700 or higher is considered a good credit score, while a score of 699 or lower is considered a poor credit score. The higher the credit score, the more likely a person is to qualify for credit.

The credit score is made up of several factors, including payment history, length of credit history, types of credit used, and credit utilization ratio. Payment history is the most important factor and accounts for 35% of the overall score. Payment history includes how often payments are made on time and how many overdue payments have been made.

Length of credit history is the second most important factor and accounts for 15% of the overall score. This factor looks at how long an individual has been using credit. Types of credit used is the third most important factor and accounts for 10% of the overall score. This factor looks at the types of credit an individual has used, such as credit cards, mortgages, and personal loans. Credit utilization ratio is the fourth most important factor and accounts for 30% of the overall score. This factor looks at how much of an individual’s available credit they are using.

It is important to maintain a good credit score in order to access credit in South Africa. Credit scores can be improved by making sure payments are made on time and by avoiding taking on too much debt. It is also important to check credit reports regularly to make sure all the information is accurate. By understanding the credit scoring system in South Africa, it is possible to achieve financial freedom.

Factors affecting one’s credit score in South Africa

When it comes to understanding a good credit score in South Africa, it is important to first explore some of the key factors that affect one’s credit score. This can help people to better manage their finances and ensure they are making the right choices to maintain a healthy credit score.

The most important factor that affects one’s credit score is how they manage their debt. This includes how much debt they have, how much they owe each month, and how often they miss payments. Paying bills on time is essential to maintaining a good credit score, as missed payments can have a negative impact on one’s score. Additionally, having a high debt-to-income ratio can be damaging to one’s credit score.

Another factor that affects one’s credit score is their credit history. The longer a person’s credit history is, the better it is likely to be. Additionally, having a diverse mix of credit types, such as credit cards, loans, and mortgages, can increase one’s credit score.

The number of credit inquiries one has can also affect their credit score. When a person applies for credit, such as a loan or a credit card, the lender will make an inquiry into their credit. Too many inquiries can have a negative impact on one’s credit score.

Finally, the type of credit one has can also affect their credit score. Credit scoring models may consider the types of credit one has, such as credit cards, loans, and mortgages, when determining their credit score.

By understanding the factors that affect one’s credit score, it can help people to better manage their finances and ensure they are making the right choices to maintain a good credit score. As a general rule of thumb, a good credit score in South Africa is usually considered to be above 650. However, each individual should strive to maintain a score as high as they can in order to maximize their chances of being approved for credit.

What is a good credit score in South Africa

When it comes to determining your financial future, a good credit score in South Africa is essential. Your credit score is a three-digit number that lenders use to measure your creditworthiness and determine whether they should approve your loan or credit card application. This number can have a huge impact on your ability to access credit and may even affect the interest rates you are offered. So, what is considered a good credit score in South Africa?

In South Africa, credit scores are calculated using a system called the National Credit Act (NCA). This system assigns a numerical range from 0 to 999 to each individual, with higher numbers representing better creditworthiness. Generally speaking, a credit score of 660 or above is considered to be a good credit score in South Africa. This score shows that the individual has a history of responsibly managing their debts and has a better chance of being approved for financing.

A credit score of 700 or above is considered to be excellent. Individuals with this score are more likely to be approved for loans and credit cards, and they may also be able to access more competitive interest rates. Having an excellent credit score can open up a world of financial opportunity and can make it easier to access the funds you need to reach your financial goals.

If you have a lower credit score, there are still ways to improve it. Make sure to pay your bills on time, avoid taking out too much debt, and keep your credit utilization ratio low. You may also want to consider registering on the National Credit Regulator’s database, which will help you to track your credit score and make sure that it is accurate. By taking these steps, you can work to improve your credit score and gain access to the financial opportunities you need to reach your goals.

Overall, a good credit score in South Africa is generally considered to be 660 or above. Having a good credit score can make it easier to access financing and better interest rates, so it is important to take steps to maintain and improve your score. By understanding the basics of credit scores and taking proactive steps, you can make sure that your credit score is as good as it can be.

Conclusion

A good credit score in South Africa is generally considered to be anything above 650. However, this is not a hard and fast rule, and there are a number of factors that can impact your credit score. If you have a good credit score, it will be easier to obtain loans and credit cards, and you may also qualify for better interest rates.