If you are a resident of South Africa, it is important to know your credit score. Your credit score is a reflection of your financial health, and it can have a huge impact on your ability to secure financing, such as a loan or a mortgage. Knowing your credit score can help you make more informed financial decisions and can also help you avoid getting into financial trouble. In this article, we will explain how to get your credit score in South Africa.

The first step to getting your credit score is to contact one of the three major credit bureaus in South Africa. These are TransUnion, Experian, and Compuscan. Each one of these bureaus will have different criteria for calculating your credit score, so it is important to contact each one to get an accurate assessment of your financial health.

Once you have contacted the bureaus, you will need to fill out an application form, which will ask for personal information such as your name, address, and contact details. You will also need to provide proof of income, such as payslips, bank statements, and tax returns. Once you have submitted all the required information, the credit bureaus will use it to generate your credit

Contents

- 1 How To Get A Credit Score In South Africa

- 2 Check your credit score regularly to have an accurate understanding of your financial standing

- 3 Research the different factors that go into calculating your credit score

- 4 Take steps to improve your credit score by paying bills on time, avoiding taking on too much debt, and disputing any incorrect information

- 5 Conclusion

How To Get A Credit Score In South Africa

Getting a credit score in South Africa is relatively easy. The first step is to open a credit account with a bank or financial institution and make sure to pay the bills on time. It is important to keep track of all your credit activities, such as loans and credit cards, to make sure that they are being reported to the relevant credit bureaus. Once you have registered with a credit bureau, they will provide you with a credit score. This score is based on your credit activity and will give you an indication of how well you manage your finances. It is important to keep an eye on your credit score and to make sure that it is up-to-date and accurate. By taking these steps, you will be able to get a credit score in South Africa and will be able to use it to make better financial decisions.

Check your credit score regularly to have an accurate understanding of your financial standing

Having a good understanding of your credit score is essential for any South African looking to build their financial future. By regularly checking your credit score, you can be sure that you’re taking the necessary steps to ensure a solid financial standing. Here’s how to get a credit score in South Africa and how to check it regularly.

The first step to understanding your credit score is to obtain your credit report. This is done by applying for a credit report from the two main credit bureaus in South Africa: TransUnion and Experian. You can do this online, or at one of their offices, and it usually costs a nominal fee.

Once you have your credit report, it’s time to look at the details. Your credit report contains important information such as your credit history, past and current credit applications, repayment and payment records, and any legal proceedings related to your credit. This information is used to generate your credit score.

Your credit score is an assessment of your creditworthiness, based on the information in your credit report. It is calculated using a formula developed by the credit bureaus, and is a way to measure your financial responsibility. Generally, a higher credit score indicates a better financial standing, while a lower score is an indication that you may not be financially responsible.

It’s important to check your credit score regularly to ensure that it is accurate and up to date. This means checking your credit report for any discrepancies, such as inaccurate information or outdated records. It’s also important to keep an eye on any changes to your credit score, as this may indicate something has gone wrong or that you need to take action to improve your score.

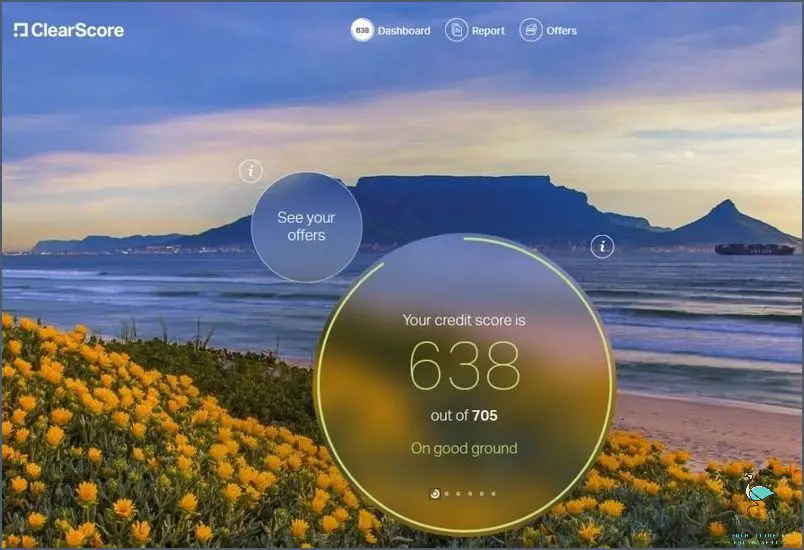

If you’re looking to check your credit score regularly in South Africa, there are a few options available. You can apply for a free credit report from the two major credit bureaus. You can also use a credit monitoring company, which will provide you with regular updates on your credit score. These services usually come at a cost, but they can be invaluable if you’re looking to stay on top of your credit.

By regularly checking your credit score, you can be sure that you’re taking the necessary steps to ensure a solid financial standing. Knowing your credit score is the first step to understanding your financial situation and taking the right steps to improve it.

Research the different factors that go into calculating your credit score

Credit scores are a major factor when it comes to obtaining loans, mortgages, and other credit services. In South Africa, there are several different factors that go into calculating a credit score, and it is important to understand what these are in order to make sure that your score is as high as possible.

One of the most important factors when calculating a credit score is the payment history. The payment history is essentially a record of how often an individual pays their bills on time and in full. Late payments and missed payments can have a significant negative effect on an individual’s credit score, so it is important to make sure that bills are paid on time and in full.

Another factor that affects a credit score is the amount of credit being used. It is recommended that the amount of credit used should not exceed 30 percent of the individual’s total credit limit. If the amount of credit used is too high, it can indicate that the individual is overextending themselves, and this can have a negative impact on their credit score.

The length of credit history is also a factor that affects a credit score. Generally speaking, the longer an individual has had credit, the better their score will be. This is because a longer credit history indicates that the individual has been responsible with their credit for a longer period of time, and lenders view this positively.

Finally, the type of credit being used can also have an impact on a credit score. It is important to have a mix of different types of credit, such as installment loans, credit cards, and other forms of credit. Having a mix of different types of credit can indicate that the individual is financially responsible and that they can manage multiple forms of credit responsibly.

By understanding the different factors that go into calculating a credit score in South Africa, individuals can make sure that their score is as high as possible. Paying bills on time, using credit responsibly, and having a mix of different forms of credit can all help to ensure that an individual’s credit score is as high as possible.

Take steps to improve your credit score by paying bills on time, avoiding taking on too much debt, and disputing any incorrect information

Are you looking to improve your credit score in South Africa? If so, you’ve come to the right place! A good credit score is essential for a variety of activities, from buying a car to renting an apartment. It can even affect your ability to get a job. Fortunately, there are a few straightforward steps you can take to improve your credit score.

The first step to improving your credit score is to ensure you pay your bills on time. Late payments can have a significant negative impact on your credit score. Set up reminders to ensure you never miss a payment and keep a close eye on your credit card statements to ensure you don’t go over your limits.

The second step is to be mindful of the amount of debt you’re taking on. While having a certain amount of debt is unavoidable, you should aim to keep it to a minimum. The more debt you have, the more difficult it will be to pay it off and the more it will impact your credit score.

Finally, you should look into disputing any incorrect information on your credit report. If there’s any information on your credit report that is wrong or outdated, you should dispute it as soon as possible. This can help to improve your credit score by removing any negative information.

By following these simple steps, you can take control of your credit score and gradually start to improve it. While it may take a while to see results, taking the time to make these changes can make a huge difference in the long run. Good luck!

Conclusion

After researching and exploring the various options available to South African citizens to get a credit score, it is clear that the most reliable and accurate way to obtain a credit score is to register with the major credit bureaus in South Africa, such as TransUnion and Experian. By registering with these bureaus, citizens can access their credit score and credit report, which will provide them with an accurate picture of their financial standing. Additionally, by regularly monitoring their credit score, citizens can protect themselves from identity theft and fraud. Furthermore, by improving their credit score, citizens can access better loan options and other financial services. In conclusion, registering with the major credit bureaus in South Africa is by far the most reliable and accurate way for citizens to get a credit score and to protect their financial interests.