It is not difficult to open an overseas bank account from South Africa if you have the required documentation. The most important requirement is to have a valid South African passport. You will also need to provide proof of your physical address and proof of income.

If you are looking to open an overseas bank account for business purposes, you will need to provide additional documentation such as a business plan and proof of business registration. Once you have gathered all the required documentation, you can contact the bank of your choice to open an account.

Contents

- 1 How To Open An Overseas Bank Account From South Africa

- 2 Selecting a Bank: Choose a bank that best meets your needs and offers the services you require.

- 3 Submit Required Documentation: Gather the necessary documents, such as proof of identity, proof of address, and proof of income, and submit them to the bank.

- 4 Open an Account: Complete the required paperwork and open the account.

- 5 Conclusion

How To Open An Overseas Bank Account From South Africa

Opening an overseas bank account from South Africa is a fairly straightforward process, though it can be a bit complex due to the various legal and regulatory requirements. The first step is to find a reputable financial institution in the country you are interested in opening an account in and make sure that they offer services to South African citizens. Once you have found an institution, you will need to complete an application and provide all necessary documents such as a valid passport, proof of address and proof of identity. Depending on the requirements of the particular bank, you may also need to provide bank statements, proof of income and other financial documents. Once the application is complete, the bank may require you to deposit a certain amount of money in the account before it is open. Once the account is open, you can begin transferring funds between the two countries and using the account for various banking services.

Selecting a Bank: Choose a bank that best meets your needs and offers the services you require.

Opening an overseas bank account from South Africa is an exciting prospect. Not only does it provide the opportunity to diversify your financial portfolio, but it also offers access to a wider range of services and products.

However, it is important to take the time to research and select the right bank for your needs. Here are some key elements to consider when selecting a bank for your overseas account:

1. Services & Products – Before committing to a bank, make sure to review the services and products they offer. Do they offer the services you need? Are their products competitively priced? Do they offer any additional benefits or discounts?

2. Fees & Charges – Fees and charges can vary between banks, so it is important to compare the fees and charges of different banks. Look for the lowest fees and charges possible.

3. Regulations & Security – Make sure that the bank you choose is regulated and secure. Review the bank’s security measures and policies to ensure that your money is safe.

4. Banking Technology – Does the bank offer the latest banking technology? Modern banking technology can help you manage your finances more efficiently and securely.

5. Customer Service – Customer service is key when selecting a bank. Look for a bank that offers reliable and friendly customer service.

By taking the time to research and compare the different banks, you can be sure to find the perfect bank for your overseas account. Do your research and choose a bank that best meets your needs and offers the services you require.

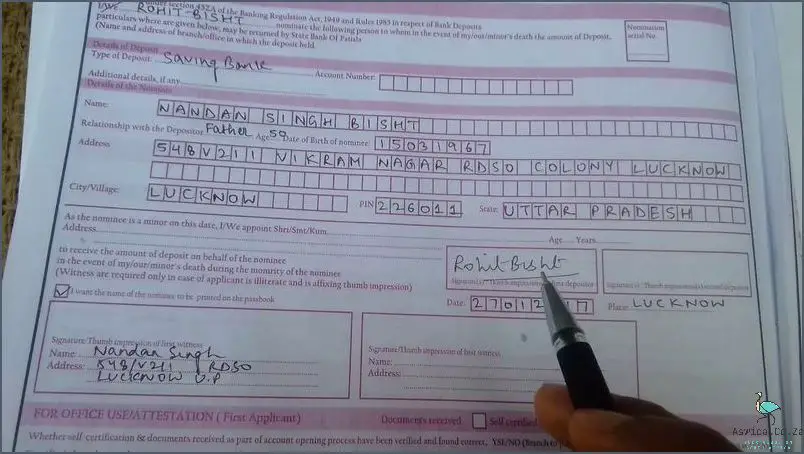

Submit Required Documentation: Gather the necessary documents, such as proof of identity, proof of address, and proof of income, and submit them to the bank.

Are you a South African considering opening an overseas bank account? This can be a great way to diversify your investments, save in different currencies, or even take advantage of different online services. But before you open an overseas bank account, you need to make sure you have all the necessary documentation.

First and foremost, you will need proof of identity. This can come in the form of a passport, driver’s license, or national identity card. You will also need proof of address, such as a utility bill or a bank statement. Finally, you will need proof of income, such as a payslip or an audited financial statement.

Once you have gathered all of the necessary documents, the next step is to submit them to the bank. This process can vary depending on the bank, so it’s important to do your research and make sure you know exactly what documents you need. For example, some banks may require more detailed financial statements than others, and some may require additional paperwork related to your assets.

After you have submitted the necessary documents, the bank will review your application and make a decision. Depending on the bank and the type of account you are opening, this process can take anywhere from a few days to a few weeks. Once the bank has approved your application, you will be able to open your account and start using it.

Opening an overseas bank account from South Africa can be a great way to diversify your investments and access different services. But before you start the process, make sure you have all the necessary documentation and that you understand the requirements of the bank. Once you have all of your documents in order, you can submit them to the bank and begin the process of opening your account.

Open an Account: Complete the required paperwork and open the account.

Opening an overseas bank account from South Africa can be a daunting task, but with the right guidance, it can be a relatively straightforward process. Whether you’re looking to diversify your investments, move money abroad, or simply want to access international banking services, knowing how to open an overseas bank account from South Africa can be an invaluable asset. Here, we’ll walk you through the various steps involved in setting up an offshore account.

The first step in the process of opening an overseas bank account is to decide which country and bank you’d like to open your account with. Different countries have different banking regulations and tax laws, so it’s important to do your research and make an informed choice. Once you’ve done that, you can start the process of gathering the necessary paperwork and documents.

In order to open an offshore bank account, you’ll need to provide your passport, proof of address, proof of income, and a few other documents. Depending on the country you’re opening the account in, you may also need to provide a valid visa, or even a local residency permit. It’s important to note that some countries may require additional documents.

Once you’ve collected the necessary paperwork, you’ll need to submit it to the bank you’ve chosen. This can be done either in person, or online. If you’re applying for an account online, you’ll usually be asked to provide a photo of yourself, as well as other identifying documents.

Once you’ve submitted your paperwork, the bank will assess your application and decide whether or not to open the account. This process can take anywhere from a few days to a few weeks. If your application is successful, the bank will then send you an account number and other information about the account.

Once you’ve received your account number and other information, you’ll need to set up a way to deposit money into your account. This can be done via wire transfer, or by transferring money from a South African bank account. It’s important to note that some countries may require you to open a local bank account in order to transfer money from South Africa.

Once your account is open and you’ve deposited money, you’ll be able to use the account for a variety of different banking services. This could include making payments, transferring funds, or even investing in international markets.

Opening an overseas bank account from South Africa is a relatively straightforward process, but it’s important to understand the different steps involved and make sure you meet all the requirements. With the right guidance and information, you can open an offshore bank account from South Africa with ease.

Conclusion

There are a few things to consider when opening an overseas bank account from South Africa. Firstly, you will need to have the required documents in order to open the account. These documents may vary from country to country, so it is important to check with the bank in advance. Secondly, you will need to consider the currency that you wish to use for your account. Some banks may only offer accounts in certain currencies, so it is important to check this in advance. Finally, you will need to decide whether you want a personal or business account. Each type of account has its own benefits and drawbacks, so it is important to consider which one is right for you.