If you are a South African citizen or a permanent resident, you need to have a tax number in order to work and to pay taxes. You can apply for a tax number online through the South African Revenue Service (SARS) website.

To apply for a tax number online, you will need to provide your personal details, contact details and ID number. You will also need to answer a few questions about your employment and income. Once you have submitted your application, SARS will issue you with a tax number.

Contents

How To Get A Tax Number In South Africa Online

Getting a tax number in South Africa is quick and easy to do online. The South African Revenue Service (SARS) provides an online service to apply for a tax number. All you need to do is register for eFiling, which will give you access to the SARS website. Once you have registered, you can apply for a tax number by completing the registration form. You will need to provide basic information such as your name, address, and contact details. Once the form is completed, you will receive your tax number immediately. It is important to keep this number safe, as it is required for many financial transactions. With your tax number, you can now eFile your taxes and make any other necessary payments to SARS.

Requirements for Obtaining a Tax Number in South Africa

If you’re a business owner or self-employed person in South Africa, obtaining a tax number is essential to ensure you are compliant with the country’s taxation laws. Thankfully, the process of obtaining a tax number in South Africa is relatively straightforward and can be done online in just a few minutes.

In this blog post, we’ll walk you through the requirements for obtaining a tax number in South Africa, as well as the process for applying for one online.

What is a Tax Number in South Africa?

A tax number in South Africa is an 11 digit number assigned to individuals or businesses that are liable for taxation in South Africa. It is also known as a South African Revenue Service (SARS) reference number.

The tax number is used to track your income and deductions, and it is also used to calculate your tax liability. It is important to note that the tax number is not the same as a value-added tax (VAT) number, which is a separate number assigned to businesses that are registered for VAT in South Africa.

Requirements for Obtaining a Tax Number in South Africa

To apply for a tax number in South Africa, you must meet the following requirements:

• You must be a South African citizen, a permanent resident of South Africa, or a foreign national with a valid work permit.

• You must have a valid South African identity document (ID) or a valid passport.

• You must be over the age of 18.

• You must have a valid residential address in South Africa.

• You must have a valid email address.

• You must have a valid South African bank account.

• You must have a valid South African cellphone number.

Applying for a Tax Number in South Africa

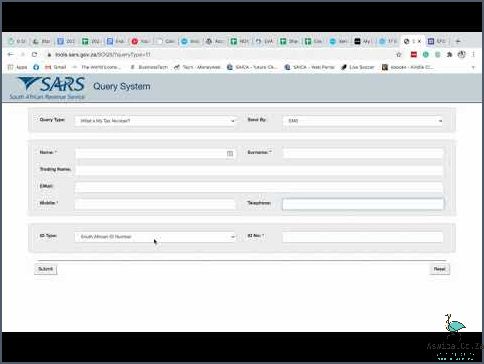

Once you have met the requirements for obtaining a tax number in South Africa, you can apply for one online. To do so, follow these steps:

• Visit the SARS website and search for the ‘Register for Tax’ page.

• Select the ‘Individual’ option and click ‘Next’.

• Enter your personal details, such as your name, date of birth, email address and residential address.

• Enter your South African ID number or passport number.

• Enter your South African bank account details.

• Enter your South African cellphone number.

• Enter the captcha code displayed on the screen.

• Click ‘Submit’.

Once you have submitted your application, you will receive an email from SARS with a unique registration number. This registration number is your tax number. It is important to keep this information safe, as it will be used to track your income and deductions, and to calculate your tax liability.

Conclusion

If you’re a business owner or self-employed person in South Africa, obtaining a tax number is essential to ensure you are compliant with the country’s taxation laws. Thankfully, the process of obtaining a tax number in South Africa is relatively straightforward and can be done online in just a few minutes. As long as you meet the requirements and follow the steps outlined in this blog post, you’ll be able to obtain a tax number in South Africa with ease.

Steps for Registering for a Tax Number Online

If you’re in South Africa and need to register for a tax number, the process can be done quickly and easily online. Here are the steps to take to make sure you get your tax number without any hassle:

1. Visit the South African Revenue Service (SARS) website and select the “Register for a Tax Number” option.

2. You will be prompted to provide your personal details, including your name, address, and contact information. Make sure to provide accurate and up-to-date information – any discrepancies may delay your registration.

3. Once you’ve completed the registration form, you will be asked to provide additional documents such as your ID or passport, proof of address, and other relevant documentation.

4. Once you’ve supplied the necessary documentation, you can then submit your application. You will receive a confirmation email once your application has been processed.

5. Your tax number will then be issued to you by SARS within a few days.

By following these steps, you should be able to register for a tax number online in South Africa with minimal fuss. Be sure to keep your tax number safe and secure and make sure to provide accurate information to avoid unnecessary delays.

Tips for Completing the Application Successfully

Are you looking to get a tax number in South Africa online? If so, then you’ve come to the right place! Here, we’ll provide you with some tips to help you complete the application process successfully. By following these steps, you’ll be able to get your tax number in no time.

1. Gather the Required Documents: Before you can apply for a tax number in South Africa, you’ll need to gather all the necessary documents. This will include your ID book, proof of residence, and your bank account information. If you don’t have all the documents, you won’t be able to submit a complete application.

2. Fill Out the Application Form: Once you have all the documents ready, you’ll need to fill out the application form. This form is available online and it must be completed in its entirety. Be sure to include all the relevant information, such as your name, address, and contact details.

3. Submit Supporting Documents: Once you’ve filled out the application form, you’ll need to submit the supporting documents. This includes your ID book, proof of residence, and bank account information. Make sure to include copies of all these documents.

4. Pay the Application Fee: After you’ve submitted the necessary documents, you’ll need to pay the application fee. You can do this online using your credit or debit card. Once the payment is processed successfully, you’ll receive a confirmation email.

5. Wait for Your Tax Number: Once you’ve completed the application process, all you have to do is wait. It may take a few weeks for the South African Revenue Service (SARS) to process your application and issue you a tax number.

Following these tips will help ensure that you complete the application process successfully and get your tax number in South Africa online. Be sure to keep a copy of all the documents you submitted, as it may come in handy in the future. Good luck!

Conclusion

After reading this article, it is evident that obtaining a tax number in South Africa online is a straightforward and convenient process. All South African citizens and residents must have a tax number in order to be able to pay taxes. The process involves the completion of the IT77 form and submission of the identity documents. Once the application is submitted, the South African Revenue Service (SARS) will issue the tax number within a few days. The tax number is a unique identification number that is used to track and report income and ensure compliance with tax laws. With a tax number, individuals can register for a variety of services, such as banking and insurance, and file an annual tax return.

Overall, getting a tax number in South Africa online is a simple and fast process. It is important for all citizens and residents to ensure that they have a valid tax number for taxation purposes.