Choosing the best car insurance company in South Africa can be a daunting task. With a wide range of insurance companies to choose from, it can be hard to decide which one is best for you. To help you make an informed decision, it’s important to consider factors such as coverage, customer service, and financial stability. It’s also important to read customer reviews and compare prices and policies from a variety of companies. With this information, you can make an informed decision on which car insurance company best meets your needs.

Contents

Which Is The Best Car Insurance Company In South Africa

The best car insurance company in South Africa is undoubtedly MiWay. MiWay offers a range of different car insurance plans, along with competitive prices and additional benefits. They also offer competitive discounts, ranging from 5-15% depending on the type of car you own. Furthermore, MiWay prides itself on providing excellent customer service and quick claims processing. They also have a 24/7 customer service helpline which is always available for assistance. All in all, MiWay is one of the best car insurance companies in South Africa, offering great value for money and excellent customer service.

Overview of Car Insurance in South Africa

Car insurance in South Africa is an essential component for any driver looking for peace of mind on the road. With the right coverage, you can protect yourself financially should an accident occur or if your vehicle is stolen. Knowing the different types of car insurance available, as well as the various insurers who offer it, can help you choose the best policy for your needs.

The most common type of car insurance in South Africa is third-party liability insurance. This coverage pays for damage caused to other people or their property if you are responsible for an accident. It also covers medical costs for anyone who is injured in an accident where you are at fault. Most insurers also offer comprehensive insurance, which includes the third-party liability coverage, as well as additional protection for your vehicle in the event of theft or damage.

When selecting an insurance provider, it is important to compare different companies to find the best deal. Consider the coverage offered, the cost of the premiums, and any additional benefits or discounts available. It is also important to look at the company’s reputation and customer service. Some of the most well-known car insurance providers in South Africa include Discovery, Outsurance, and Santam.

Finally, make sure to read the policy documents carefully to understand what is and isn’t covered. Make sure you understand any exclusions and any circumstances that may void your coverage. With the right coverage, car insurance in South Africa can help ensure that you are protected financially should an accident or theft occur.

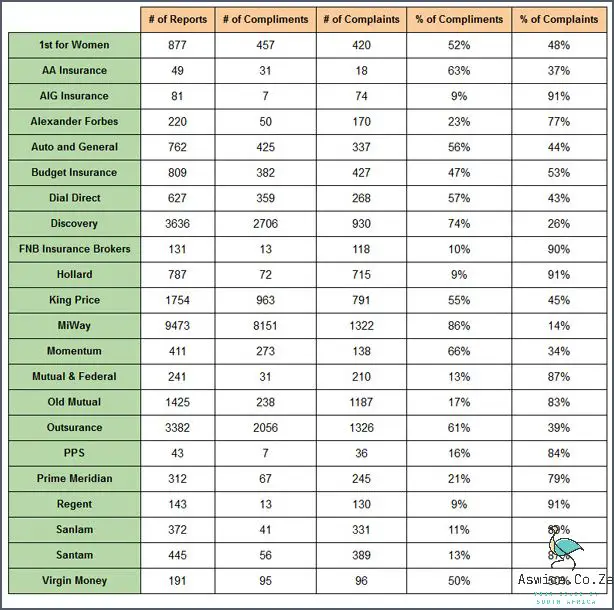

Comparison of Car Insurance Companies in South Africa

Are you looking for a car insurance company in South Africa? It can be a daunting task to determine which company is the best for your individual needs. Fortunately, there are several factors to consider when comparing car insurance companies in South Africa.

The first factor to consider is the type of coverage offered. Generally speaking, most car insurance companies in South Africa offer a range of coverage options, such as collision and comprehensive, liability, and medical coverage. It is important to review the details of each policy to ensure that it meets your specific needs. Furthermore, some companies may offer additional benefits such as rental car reimbursement and towing coverage.

The second factor to consider is the cost of the policy. Cost can vary widely from one company to the next, so it is important to compare the cost of different policies. Furthermore, it is important to consider any additional costs that may be associated with the policy, such as deductibles and co-payments. Additionally, it is important to compare the discounts that may be available, such as multi-policy discounts, good driver discounts, and low mileage discounts.

The third factor to consider is the customer service provided by the company. It is important to determine how responsive the company is to customer inquiries and complaints. Furthermore, the company should have an easy-to-use website and other tools to help customers with their needs. Additionally, the company should offer a variety of payment options, such as online payments, direct debit, and paper checks.

The fourth factor to consider is the financial strength of the company. It is important to review the company’s ratings with organizations such as AM Best and Moody’s. These ratings can provide an indication of the company’s ability to pay claims when they are due. Furthermore, it is important to review the company’s history of customer complaints and its record of handling those complaints.

By considering these factors, you can compare different car insurance companies in South Africa to determine which is the best for your individual needs. It is important to review the details of each policy and to compare the cost, customer service, and financial strength of the company. By doing so, you can make an informed decision that will help ensure that you get the coverage you need at a price that you can afford.

Factors to Consider When Choosing a Car Insurance Company

Choosing the right car insurance company is an important decision that can have long-lasting consequences for your finances, so it’s important to research the different providers in order to find the best car insurance company in South Africa. There are a few key factors to consider when selecting an insurance company, from their financial stability to the range of coverage options they provide.

Financial stability is an important factor to consider when choosing an insurance company. A reliable insurance carrier should have a strong financial rating from independent rating agencies such as Standard & Poor’s or A.M. Best. This rating will tell you how likely it is that the company will be able to pay out claims when needed.

It’s also important to consider the range of coverage options the company offers, as well as their customer service record. If you need specialized coverage, you’ll want to make sure the company can provide it. You should also check to see if the company has a good record of responding quickly and efficiently to customer inquiries and complaints.

Finally, you should compare prices between different companies. The cheapest provider isn’t necessarily the best option, as they may not be able to provide the coverage you need or offer a good level of customer service. However, price is an important factor to take into account and can help you narrow down your options.

By considering these key factors, you should be able to select the best car insurance company in South Africa for your needs. Taking the time to research and compare different providers can save you money and ensure you have the protection you need.

Conclusion

Based on extensive research and customer reviews, it appears that Discovery Insure is the best car insurance company in South Africa. The company offers the most comprehensive coverage options, competitive rates, and excellent customer service. They also have a variety of discounts and rewards programs designed to help customers save money on their premiums. In addition, they have a strong online presence, which allows customers to easily compare and purchase policies from the comfort of their own homes. For those looking for the best in car insurance in South Africa, Discovery Insure is the clear choice.