Adding Value Added Tax (VAT) to a business in South Africa is a process that needs to be done correctly in order to be compliant with the South African Revenue Service (SARS). VAT is a tax on goods and services that is charged by the seller to the buyer. It is collected by the seller from the buyer and paid to SARS. In South Africa, the VAT rate is currently 15%.

In order to add VAT to your business in South Africa, you need to register for a VAT number with SARS. You will need to provide information such as your business address, business details, and a valid South African identity number. Once your registration is complete, you will receive a VAT number. This number must be included on all invoices and other documents related to your business.

Once you have your VAT number, you need to be aware of the rules and regulations related to VAT. You will need to ensure that you charge the right amount of VAT on all your sales and that you account for the VAT correctly. You must also submit your VAT returns to SARS on a regular basis.

Finally, it is important to remember that when you are adding VAT to your business in South Africa, it

Contents

How To Add Vat South Africa

Adding VAT in South Africa is a relatively straightforward process. First, the business must register for the Value Added Tax (VAT) with the South African Revenue Service (SARS). Next, the business must obtain a VAT registration number, which is used for all VAT-related activities. When filing the VAT return, businesses must report the amount of VAT collected from customers, as well as any input tax that the business has paid out. To pay the VAT due, businesses must make a payment to SARS, either electronically or by cheque. Finally, businesses must keep accurate records of all transactions related to VAT and make sure that their accounts are up to date. By following these steps, businesses in South Africa can ensure that they are compliant with the VAT regulations and ensure they pay the correct amount of VAT to SARS.

Determine if you are a ‘VAT vendor’ and need to register for VAT

Are you a business owner in South Africa? Do you want to make sure you’re complying with all the required tax regulations? Well, you may need to register for Value Added Tax (VAT). In this blog, we’ll take a deep dive into the process of determining if you need to register for VAT and how to add VAT in South Africa.

First, let’s start by understanding what VAT is. Value Added Tax (VAT) is a consumption tax levied on goods and services. In South Africa, VAT is administered by the South African Revenue Services (SARS). It is a mandatory tax for all registered businesses and it is their responsibility to collect and remit the payments to SARS.

Now, let’s take a look at how to determine if you need to register for VAT. In South Africa, businesses must register for VAT if their total turnover (sales) exceeds R1 million in any consecutive 12-month period. This means that if you are a business owner in South Africa and your turnover exceeds R1 million in any 12-month period, you are required to register for VAT. However, if your turnover falls below R1 million, you are not obligated to register for VAT.

If you do need to register for VAT, you must do so within 21 days of the date the registration threshold was exceeded. To register for VAT, you must submit the VAT101 registration form to SARS. The form must be submitted online and can be found on the SARS website. Once you’ve completed the form, you must then submit all the supporting documents required by SARS.

Once your VAT registration is complete, you must then start charging VAT on all your sales. This means that you must add 14% VAT to all your invoices. The VAT amount collected must then be paid to SARS on a monthly basis. It is important to note that failure to pay the VAT amount due to SARS can lead to penalties and fines.

In conclusion, if you are a business owner in South Africa and your turnover exceeds R1 million in any 12-month period, you must register for VAT and start charging VAT on all your sales. To register for VAT, you must submit the VAT101 registration form to SARS, along with any supporting documents. Once your registration is complete, you must then start charging VAT on all your invoices and remit the payments to SARS on a monthly basis.

We hope this article has shed some light on the process of determining if you need to register for VAT and how to add VAT in South Africa. If you need any further assistance with your VAT registration, please do not hesitate to contact a professional tax consultant.

Calculate the VAT you will charge on sales

When it comes to running a business in South Africa, one of the most important topics to consider is VAT (value-added tax). Knowing how to calculate VAT on sales and apply it correctly is a crucial part of managing a successful business. In this article, we’ll explain the basics of VAT in South Africa, and how you can use it to add value to your business.

The South African Revenue Service (SARS) defines VAT as a form of indirect tax, and any business registered with SARS must charge it on the sale of goods or services to consumers. It’s important to note that the purchaser is the one who ultimately pays the VAT, not the business.

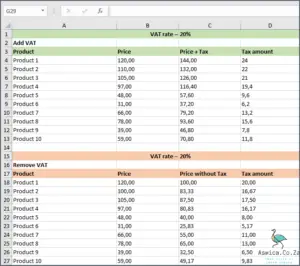

To calculate the amount of VAT you will charge on sales, you need to know the VAT rate in South Africa. This is currently set at 15% and is applied to the cost of the goods or services you are selling. So, if you have sold a product for R100, the amount of VAT you will charge is R15.

If you are registered for VAT as a business, you will also need to calculate your output VAT. This is the amount of VAT you charge your customers on the goods and services you sell. To calculate output VAT, simply multiply the value of the goods or services you have sold by the current VAT rate.

For example, if you sell a product for R200, the amount of VAT you will charge your customer is R30. This means the total amount the customer pays is R230.

In addition to output VAT, you will also need to calculate your input VAT. This is the amount of VAT you paid to your suppliers on the goods and services you purchased. To calculate input VAT, you will need to subtract the amount of output VAT you have charged from the total amount of VAT you have paid to your suppliers.

For example, if you paid R120 in VAT to your suppliers and charged R30 in VAT to your customers, the amount of input VAT you can claim is R90. This means you have paid R30 more in VAT than you have charged your customers, and you can use this to reduce your tax liability.

In conclusion, calculating VAT is an important part of running a business in South Africa. Knowing how to calculate and apply it correctly can help you maximize your profits and reduce your tax liability. So, make sure you keep track of the VAT you charge and pay to ensure you are compliant with SARS regulations.

Register for VAT with the South African Revenue Service (SARS)

If you’re a business owner in South Africa, you’re likely familiar with the process of registering for Value Added Tax (VAT) with the South African Revenue Service (SARS). VAT is a form of indirect tax that is applied to the sale of goods and services, and is levied at a standard rate of 15%.

The process of registering for VAT with SARS can seem daunting, but it doesn’t have to be. Here’s a step-by-step guide to help you through the process:

1. Determine your VAT status: Your VAT status is based on the value of your annual turnover. If your turnover is greater than R1 million, you must register for VAT with SARS. If your turnover is less than R1 million, you may opt to register for VAT voluntarily.

2. Gather the necessary documentation: To register for VAT with SARS, you will need to provide your company’s registration documents, a valid South African ID, and proof of residence.

3. Complete the VAT101 form: This form can be found on the SARS website and must be completed in full. It includes questions regarding your business’s financial information as well as your personal information.

4. Submit the form and additional documentation: Once the form is complete, you can submit it online, along with the additional documentation, to SARS.

5. Wait for approval: SARS will review your application and you will receive notification of approval (or rejection) within 14 days.

Once approved, you will receive a VAT number and be required to submit VAT returns every two months. It is important to note that if your business’s turnover exceeds R2 million in any 12-month period, you must submit monthly VAT returns.

Registering for VAT with SARS may seem overwhelming, but following these steps will help simplify the process. Good luck!

Conclusion

Adding VAT in South Africa is a relatively simple process, and can be done either manually or through the use of accounting software. When adding VAT manually, businesses will need to keep track of their VAT-exclusive and VAT-inclusive sales, as well as their VAT liability. businesses can use accounting software to automate the process of adding VAT. This can help to save time and ensure that VAT is calculated correctly.