The current exchange rate in South Africa is the rate at which the South African Rand (ZAR) is traded for other currencies. It is determined by the demand for and supply of the currency in the foreign exchange market. The exchange rate is determined by a range of factors such as the economic stability of South Africa, the strength of the South African currency, and the political and economic conditions of other countries. The exchange rate also fluctuates due to global events, such as the US-China trade war or Brexit. The exchange rate is an important indicator of the health of South Africa’s economy and a useful tool for investors and exporters.

Contents

What Is The Current Exchange Rate In South Africa

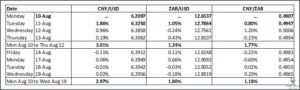

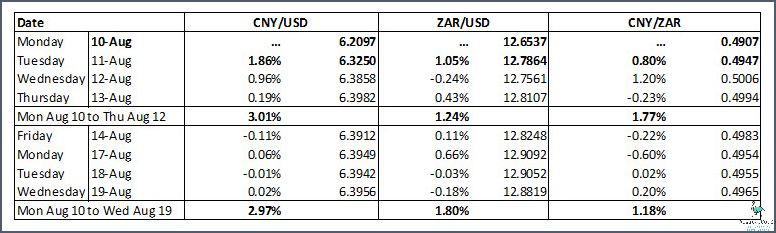

The current exchange rate in South Africa is 14.54 South African Rand (ZAR) to 1 United States Dollar (USD). This rate has increased slightly over the past few weeks, and is currently up 0.3% from the previous week. The South African currency has seen large fluctuations in the recent years, but has been relatively stable since mid-2019. The South African Rand is also used in Namibia and Lesotho, and is typically seen as a more volatile currency due to its relatively low liquidity. Investors should monitor any changes in the exchange rate as it can have a significant effect on their investments.

Overview of South Africa’s economy

South Africa has experienced a tumultuous economic history, but the current exchange rate in South Africa is a source of optimism for many. The South African Rand (ZAR) is the official currency of the country and is currently trading at an exchange rate of around 14.5 ZAR to 1 USD. This is a significant improvement over the past few years, when the exchange rate was closer to 19 ZAR to 1 USD.

The improved exchange rate reflects a number of positive economic trends in South Africa. The country has seen an increase in foreign investment, which has driven up demand for the South African Rand. Additionally, the South African government has implemented a number of economic reforms, including cutting public sector spending, which has improved the country’s fiscal position.

The improved exchange rate has been beneficial for South African citizens. Lower exchange rates make it easier for South Africans to purchase imports, while also making it cheaper for foreign investors to invest in the country. This has created a more favorable environment for businesses to invest, leading to increased economic growth.

The South African government has also implemented a number of policies to help keep the exchange rate stable. For example, the government has implemented a system of managed exchange rates, where the exchange rate is adjusted according to the country’s economic conditions. This helps to ensure that the exchange rate does not fluctuate too wildly and is beneficial for South African citizens.

Overall, the current exchange rate in South Africa is a source of optimism for many. The improved exchange rate has been beneficial for South African citizens, businesses, and foreign investors, and the government’s policies have helped to ensure that the exchange rate remains stable. As long as the South African government continues to implement sound economic policies, it is likely that the exchange rate will remain favorable for the foreseeable future.

Factors that affect South Africa’s exchange rate

The South African exchange rate is one of the most volatile and unpredictable elements of the country’s economy. It is a reflection of the country’s economic health and can be influenced by a number of factors. Here we take a closer look at the main factors that affect South Africa’s exchange rate.

One of the most powerful forces influencing the exchange rate is the balance of payments, which is the difference between the value of money flowing into the country and money flowing out. When the balance of payments is positive, the exchange rate strengthens and when it is negative, the exchange rate weakens.

South Africa’s political stability is also an important factor. Political unrest or uncertainty can cause investors to lose confidence in the economy, leading to an outflow of capital and a weakening of the currency.

The level of inflation also has an effect on the exchange rate. High inflation can lead to a depreciation in the currency’s value, while low inflation can lead to an appreciation.

The cost of imports and exports also plays a role. If the cost of imports is high, it can lead to a weakening in the exchange rate as it takes more of the local currency to buy goods from other countries.

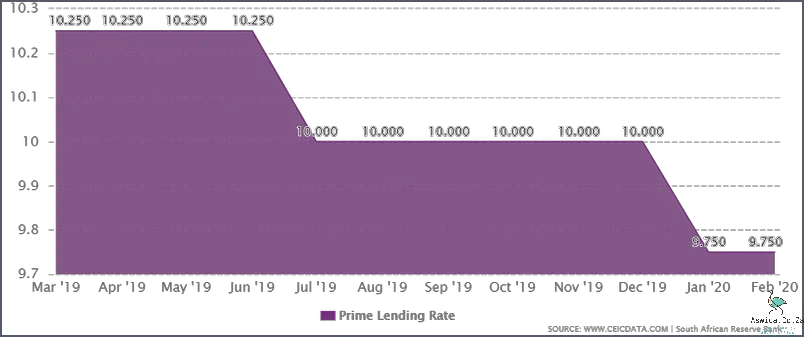

Finally, South Africa’s interest rates are an important factor in determining the exchange rate. Higher interest rates tend to make the currency more attractive to investors, leading to an appreciation of the currency.

All of these factors combined can have a significant impact on the exchange rate in South Africa. In order to get an accurate picture of the current exchange rate, it is important to take all these factors into account.

Current exchange rate in South Africa

South Africa is one of the most diverse and vibrant countries in the world, so it makes sense that the exchange rate in this nation would be equally as dynamic. Indeed, the current exchange rate in South Africa is in a constant state of flux, reflecting the ever-changing economic reality of the country.

At present, the South African Rand (ZAR) trades against the US Dollar at a ratio of 1:14.45. This means that one US Dollar currently equates to 14.45 Rand, making it a relatively weak currency compared to the Dollar. The Rand has been steadily depreciating against the greenback since 2017 and is expected to remain weak for the foreseeable future.

The South African exchange rate is also influenced by other currencies, such as the Euro and the British Pound. Currently, one Euro is worth 17.07 Rand, while one British Pound is worth 19.25 Rand. This means that both the Euro and the Pound are relatively strong currencies compared to the Rand, with the Pound being the strongest of the three.

It is important to note that the exchange rate in South Africa is not static and can fluctuate greatly over time. Political and economic events, such as elections and economic recessions, can have a huge impact on the local exchange rate. Similarly, changes in global economic trends, such as trade wars and currency devaluations, can also affect the South African exchange rate.

Overall, the current exchange rate in South Africa is a reflection of the country’s economic and political situation. Despite the Rand’s weakness, the nation’s economy is relatively strong and stable, which bodes well for the future of its currency. With the right economic policies and a little bit of luck, the South African Rand could well make a comeback in the coming years.

Conclusion

The current exchange rate in South Africa is 14.86 South African Rand for 1 US Dollar. This rate has been relatively stable over the past few months, although there have been minor fluctuations. This exchange rate is an important indicator of how the South African economy is performing and how it is likely to perform in the future. It is also important for businesses and individuals who need to exchange money for international transactions.